If you’re one of the many Americans who say they had to pinch pennies during major holidays this year, you may be seeking ways to cut back and spend less in 2026. One thing to consider is entering the year with a new mindset about money.

Enter the “low buy” January, in which you reduce your expenses for the first month of the year. Where you need to cut back depends on how you tend to spend — maybe you splurge on sales a little too regularly, or you order takeout while food goes to waste in your fridge — but no matter what categories you cut back on, the goal is to save more money, and hopefully cut out financial habits that no longer serve you.

Want to try it? Here are some tips from personal finance creators on social media to help you get started.

Put items on a wishlist before pulling the trigger

The ease of online shopping means spending money is as simple as clicking a button. That’s why social media creator Lydia, a certified accountant who posts budgeting and saving content on her Money Moves With Lydia TikTok and Instagram pages and has more than 144,000 followers combined, said it’s important to move from “impulse” to “intentional” spending.

She recommends that those kicking off a low-buy January put anything they wish to purchase on a list they can revisit after 30 days. “If in 30 days you still want to buy the item, go ahead,” she told Yahoo in a phone call, noting that people often forget why they wanted the thing in the first place.

Be intentional about dining out

If you find yourself spending too much money on food, whether that’s going out to eat or ordering in, there are ways to scale back without feeling deprived of experiences you enjoy. That’s where Lydia’s “intentional” vs. “impulsive” spending comes into play again. Instead of forcing herself to make every single meal at home in order to save the most money, Lydia said that she avoids the pull of food delivery by telling herself that if she wants to skip having to prepare a meal on her own, it has to be for an occasion outside of the house, like going to a restaurant with her husband.

“I know I'm going to go to eat, but it's intentional — and it's more enjoyable, because if I'm spending $60 for dinner, I’m making a date out of it, and it's quality time,” she explained. “It makes me happy, I don't regret it, and I'm happy about the purchase.”

You don’t have to stick to Lydia’s specific rules, of course. If you prefer different quality-time activities for hanging out with friends or a partner, you may skip restaurants and opt for delivery only on Sundays, for example. Setting a rule for when you can spend, rather than resorting to it when you’re feeling overwhelmed or lazy, can help you save money over time.

Skip subscription entertainment services — or just scale back

Subscription services like Netflix can be pricey, especially if you pay for premium versions without commercials. But these services aren't the only way to get quality content. Kaylonie Davis, creator of The Budgeting Princess TikTok account, which creates budgeting tools to help followers save money, suggested that those who don’t want to spend money should “swap paid services for free or low-cost options — like using the local library for DVDs, audiobooks, ebooks, and even streaming apps.” For example, the Libby app offers free audiobooks you can listen to on your phone and books that you can send directly to your e-reader, making the experience almost identical to having a paid account. Hoopla also provides free digital content from the library.

“January is a great time to cancel or pause subscriptions that aren’t being used regularly,” Davis explained via email. “I recommend keeping only what’s actively used and revisiting subscriptions quarterly instead of letting them run in the background.”

Adore rewatching shows like Emily in Paris too much to quit subscription services altogether? Instead, consider a different, lower-cost approach: sign up for just one subscription at a time, as personal finance creator Michela Allocca, who has more than 899,000 followers on TikTok, shared in a September TikTok. This way, you can binge all the things you want to see on Netflix before moving on to Hulu, then Disney+, and so on and so forth.

Delete, unfollow, block and unsubscribe

It’s easy to see something online and decide you need it — even if you didn’t know that “it” existed before you saw that creator posting about it on social media. Our online habits can encourage us to spend money, Dr. Michael Kane, board-certified psychiatrist and chief medical officer at Indiana Center for Recovery, told GoBankingRates, because of our “fear of missing out” or FOMO.

“It’s that feeling you get when you see others enjoying something you don’t have, like the latest gadget or trendy shoes,” he explained. “This fear can push someone to buy something just to keep up or to fit in, even if they didn’t plan on buying it in the first place.”

One way to make a low-buy January easier, budgeting creator Rebecca Sowden suggested in a recent TikTok, is to cut out as much of this content as possible. Unsubscribe from emails sent by your favorite clothing store, which will tempt you with sales. Mute or block creators who are pushing new makeup. Delete shopping apps that make it too easy to make purchases.

Want to go even further? Train your algorithm by liking and following budgeting or anti-consumerism content, which can help shut out some of the noise that encourages spending.

Get into Project Pan

If you tend to buy new things before you’ve finished the ones you already have, consider starting the “Project Pan” challenge in January. It’s a practice in which you replace something only when you’ve finished the one you already have. It can apply to things like makeup (so you’re finally hitting the “pan” of a blush palette, for example), but also to other stuff you may be too quick to replace, like that peanut butter jar or shampoo bottle that’s half full.

Given how easy it is to replace something when you truly need it (and really, will there ever be a blush emergency?) Project Pan can stop you from overconsuming, not to mention reduce clutter from all the product duplicates around your home.

"It's a great way to challenge the culture of consumption that encourages us to always buy more instead of fully enjoying what we already own," Shira Gill, organizing expert and author of Minimalista, told Good Housekeeping. "For many people, this isn't just a trend — it's a mindful way to live."

LATEST POSTS

- 1

Extreme Manual for Picking a Camper Van

Extreme Manual for Picking a Camper Van - 2

Find the Mysteries of Powerful Using time productively: Augmenting Efficiency and Proficiency

Find the Mysteries of Powerful Using time productively: Augmenting Efficiency and Proficiency - 3

One third of Spanish pork export certificates blocked since swine fever outbreak, minister says

One third of Spanish pork export certificates blocked since swine fever outbreak, minister says - 4

More parents refusing this shot that prevents serious bleeding at birth

More parents refusing this shot that prevents serious bleeding at birth - 5

10 Natural products to Remember for Your Eating routine for a Better You

10 Natural products to Remember for Your Eating routine for a Better You

Collierville residents with no power as temperatures plunge

Collierville residents with no power as temperatures plunge What exactly is the Upside Down in 'Stranger Things'? The wormhole revelation, explained.

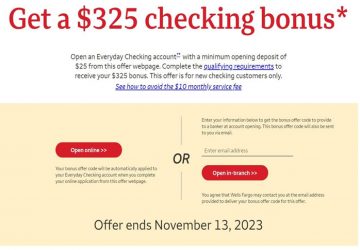

What exactly is the Upside Down in 'Stranger Things'? The wormhole revelation, explained. Figure out How to Score Huge with Open Record Rewards

Figure out How to Score Huge with Open Record Rewards Cases of norovirus are on the rise just in time for the holiday season

Cases of norovirus are on the rise just in time for the holiday season ‘Trip of suffering’: Gaza evacuee details 24-hour journey to South Africa

‘Trip of suffering’: Gaza evacuee details 24-hour journey to South Africa 5 Advancement Developments in Biotechnology

5 Advancement Developments in Biotechnology Mom finds out she has cancer after noticing something was off while breastfeeding

Mom finds out she has cancer after noticing something was off while breastfeeding Figure out How to Ascertain the Restitution Time frame for Your Sunlight based chargers

Figure out How to Ascertain the Restitution Time frame for Your Sunlight based chargers Israel faces tough choices over haredi draft exemptions, legal expert warns

Israel faces tough choices over haredi draft exemptions, legal expert warns